When it comes to leasehold properties, particularly Singapore's unique public housing, HDB flats, the concept of remaining lease plays a significant role in determining their value. In this blog post, we will delve into the intricacies of leasehold properties and how the remaining lease affects their market worth.

Understanding Leasehold and Its Impact

HDB flats are initially offered with a 99-year lease tenure. However, recent developments have introduced a new flat type known as a 2-room Flexi, which offers varying lease durations depending on the age of the flat owner at the time of application.

The chosen lease duration directly influences the purchase price and subsequent monthly mortgage/rental payments.

Calculating the Remaining Lease

Determining the remaining lease is a straightforward process. It involves subtracting the property's age from the lease tenure. Let's take the Tiong Bahru flat mentioned previously for example -

The flat TOP'd in 1973, or 50 years ago. (2023-1973=50)

It has a standard leasehold of 99 years.

Therefore, the balance lease for this property would be 49 years. (90-50=49)

Owners can sell or pass down their HDB flats during their ownership, and the new owner will assume the remaining lease. However, only flat owners who initially opted for a 99-year lease are allowed to resell their flats in the open market.

A noteworthy case is the 191 terrace houses at Geylang Lor 3, which were returned to the state on December 31, 2020, after the end of its 60-year lease, marking the first occurrence of such a situation in Singapore.

This incident provided insights into the potential future scenario as 99-year HDB leases begin to expire. As more properties revert to the state, it sets a precedent for how the government may handle the process of HDB flats with expired leases.

Impact of Remaining Lease on Property Value

Properties with longer remaining leases provides owners with more time to enjoy and utilize the property, which is reflected in their higher value.

Buyers often prefer properties with longer leases due to the added security they offer. Conversely, as the lease term decreases, the property value typically depreciates. As the lease approaches its expiration date, the property's worth diminishes, leading to buyers being less willing to pay a premium for a property with a short remaining lease.

Challenges Faced by Older HDB Flats

Owners of older flats may also encounter difficulties when selling their properties in the future due to various restrictions and concerns. Possible concers include:

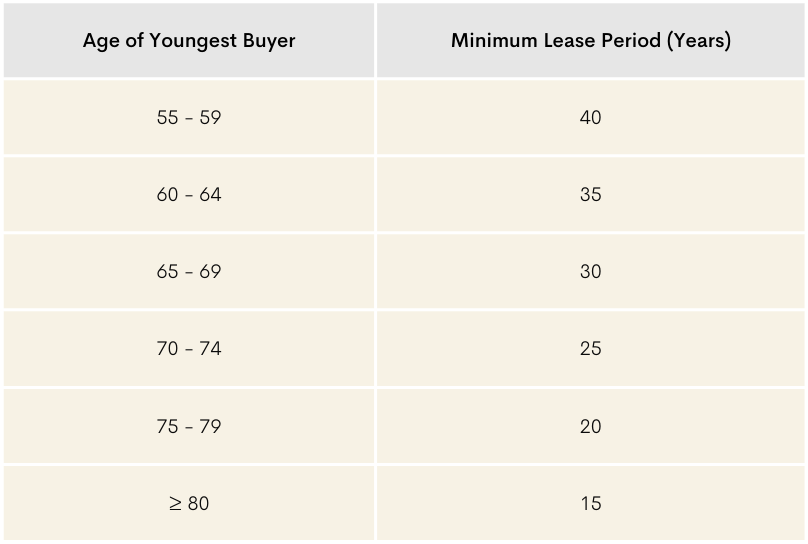

Loan Restrictions - Insufficient lease coverage until age 95 results in pro-rated LTV limits.

Housing Grants - Grant amount reduced and pro-rated if remaining lease cannot cover buyer until age 99.

CPF Usage - The remaining lease must cover the youngest buyer until age 95 for full CPF usage, or else CPF can be used at a pro-rated amount.

Analyzing Market Trends

To further illustrate the impact of remaining leases on property value, we have generated graphs comparing per square foot sold for HDBs in different TOP years.

The observation:

Here's something interesting - check the performances of the same HDBs between the year 2015 to 2019 in both Table 1 and Table 2 when the whole property market was rather stagnant.

Prices for HDBs TOP'd in 1988, 1998, 2008 (Table 1) and 2003 and 2011 (Table 2) are still inching upwards gradually spreading over 4 years. From observation, the younger ones, has a steeper increment compared to the older ones. You may also notice prices for HDBs that TOP'd in 1978, 45 years old from Table 1 and 1980, 43 years old from Table 2, were actually dipping in the same market.

This means - a property's value starts to depreciate when it hits 40 years old.

Case Study: Tiong Bahru

Despite having a balance lease of 49 years, the Tiong Bahru HDB flat along Moh Guan Terrace recently sold at a record-high price of $1.5 million. This exceptional case can be attributed to factors such as the area's unique low-rise, low-density HDB blocks and its old-world charm. The property's large size, combining two 3-room flats into a spacious 1894 sqft unit also contributed to its premium value. For comparison, a typical 4-room BTO unit has a floor area of 1,001 sqft.

What about the other HDBs in the area? Let's see.

Considering our discussion on depreciating property values caused by lease decay, we have generated the following table showcasing the average price per square foot (PSF) of 3-room, 4-room, and 4-room adjoining flats (Jumbos) that attained their TOP (Temporary Occupation Permit) before 1983, representing properties that are 40 years and older. This table provides further insights into the trend of property values affected by lease expiration.

The observation:

Table 3

The data presented supports our initial observation that properties older than 40 years, such as those in the Moh Guan Terrace cluster, tend to experience a decline in value. Conversely, the younger properties, like those in Membina Court (TOP in 2008/2009) and Bukit Merah View (TOP 1996), demonstrate a more resilient trend, either retaining their value or experiencing gradual increases even in a stagnant market condition.

Table 4

The sale volume of Jumbo flats is significantly lower compared to 3-room and 4-room flats, as evident from Table 4. This scarcity is due to the fact that HDB has ceased constructing Jumbo units since a specific date (exact date not provided). Consequently, the supply of Jumbo flats is limited, unless neighboring units are acquired to form an adjoining flat.

In the Moh Guan Terrace cluster, there are a total of 322 units, predominantly consisting of 2-3 room flats. Only 5 units are 4-room adjoined flats (Jumbos). The rarity of Jumbo flats contributes to their high demand. Furthermore, their spacious floor size of 1894 sqft justifies the premium prices they command.

Interestingly, the trendline for Jumbo flats in the cluster shows a contrasting direction compared to 3-room and 4-room flats during the stagnant market period from 2015 to 2019, despite having the same remaining lease duration. The graph suggests that Jumbo flats have better value retention.

Woodlands: Exploring Different HDB Types

Additionally, we have examined different HDB types to understand their performance in relation to lease decay. By analyzing the table below, there seems to be a varying trend among different unit types. Notably, bigger unit types, such as Executives and Jumbo flats, tend to exhibit better resistance to the effect of decaying leases. (Refer to Table 5)

The observation:

All HDBs type depreciated in value between 2015-2019.

Executives, compared to other unit types, demonstrate greater resilience against the impact of decaying leases. This finding suggests that larger unit types serve as a better hedge against the effects of lease decay.

Why is this the case? The buyers of bigger units, such as Executives, are typically upgraders who have profited from their previous properties or have more working experience, resulting in increased savings in cash or CPF (Central Provident Fund). As a result, they are not as constrained by CPF limitations, loan restrictions, or reduced housing grants, which are factors that can significantly affect the affordability and financing options for smaller unit types.

This greater financial flexibility allows buyers of bigger units to navigate the challenges posed by decaying leases more effectively, contributing to their relative resilience in terms of value retention.

Conclusion

It's undeniable that a short remaining lease can have a significant impact on your property's value. BUT, larger, rarer, HDB flats are the exception to the general trend. The recent sale of the $1.5 million Tiong Bahru flat is a prime example.

Factors like location, favourable market conditions, or even just the buyer's personal preference can defy the odds and influence the value of a property, even with a shorter remaining lease.

If you currently own or are contemplating purchasing a property with a shorter remaining lease, we encourage you to send us a DM @HomeGen.SG on Instagram, Facebook or TikTok and we can evaluate further. Alternatively, feel free to leave a comment below and we'll get in touch with you.

.png)

Comments